Since 1999, the artist collective RYBN.ORG has documented the ways in which algorithmic governmentality has infiltrated our society,1 through speculative story-telling, art pieces, and experimental protocols. Conducting extra-disciplinary artistic investigations,2 the collective examines high-intensity sites and phenomena—high-frequency financial markets, the microwork marketplace, offshore financial networks—which contain and foretell the potentially radical technical, political, and social transformations to come.

Starting with the Antidatamining series in 2005, the collective has focused on the developments of data mining and Big Data, undertaking the task of meticulously deconstructing the methods of algorithmic trading in order to display them in a kind of cabinet of curiosities. This examination of contemporary economic structures was furthered in their 2017 documentary piece The Great Offshore, which deals with the normalized networks of offshore finance and, inter alia, the automated methods that have emerged in the field of asset management and optimization. Lastly, with Human Computers, an ongoing study initiated in 2015, the collective has concerned itself with the microwork market,3 a place where algorithms and Artificial Intelligence are trained and developed—a laboratory for methods of extreme erasure, outsourcing, and the rational organization of human labour.

Each of these projects is based on meticulous mediarchaeological investigations,4 bringing about new historical and technological genealogies and shedding light on the undeniable global governance-by-numbers5 currently underway. These studies are built on a large corpus of archives, patents, news articles, scientific papers, scientific popularisation books, technical objects, computer codes, etc. The cross-analysis of these documents is the foundation of these artistic experimentations, which, by transmuting analysis into aesthetic experience, allows us to understand what lies beneath the consecutive layers and generations of technological innovation—Big Data, algorithms, Artificial Intelligence.

By exploiting and nestling within network infrastructures and protocols like data centres, cloud computing, and human-in-the-loop protocols, these artistic experiments re-model6 and reveal the new cybernetic spirit of capitalism.

1 – Antidatamining series (2005/2015)

1.1 – ADM 8 (2011)

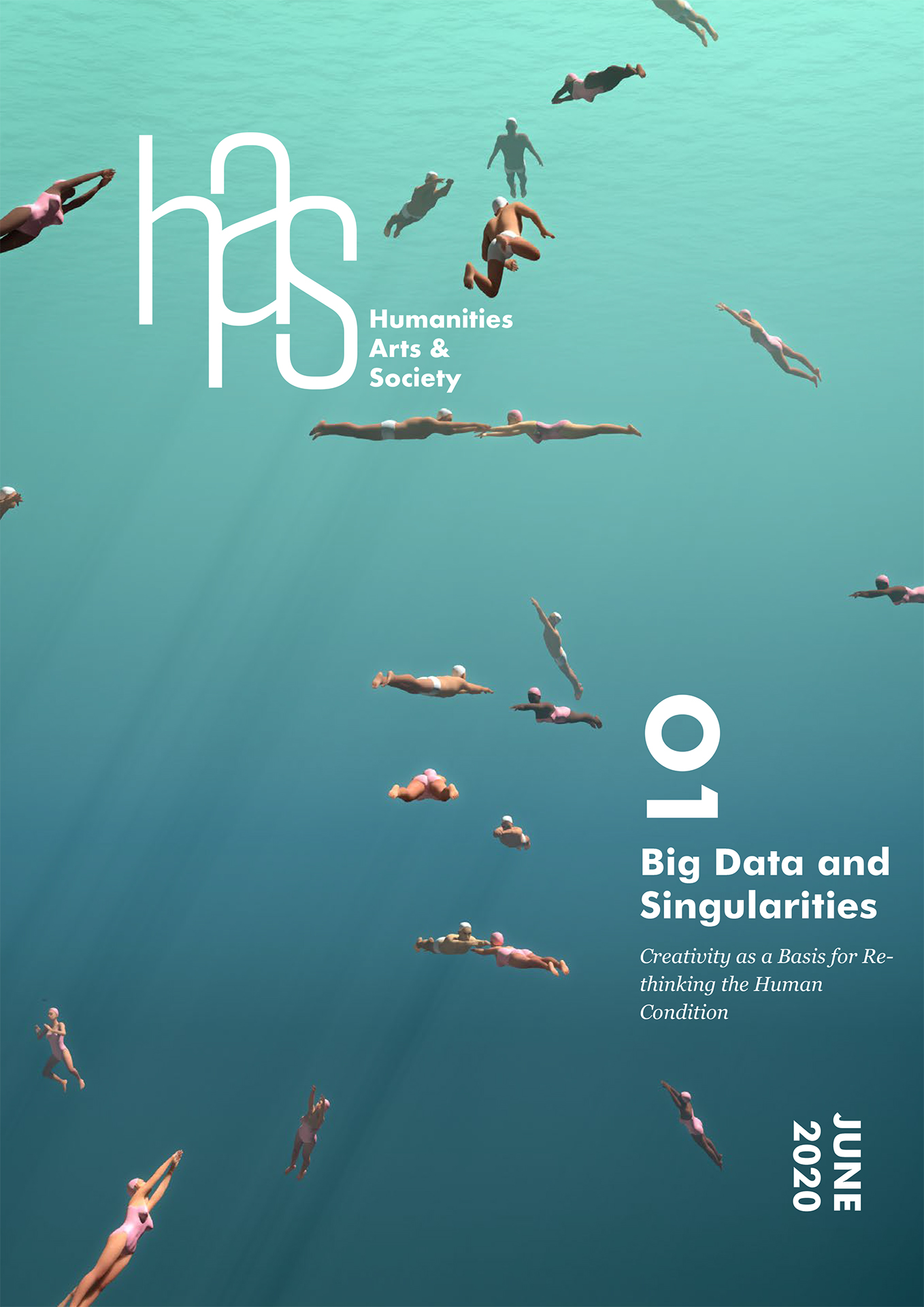

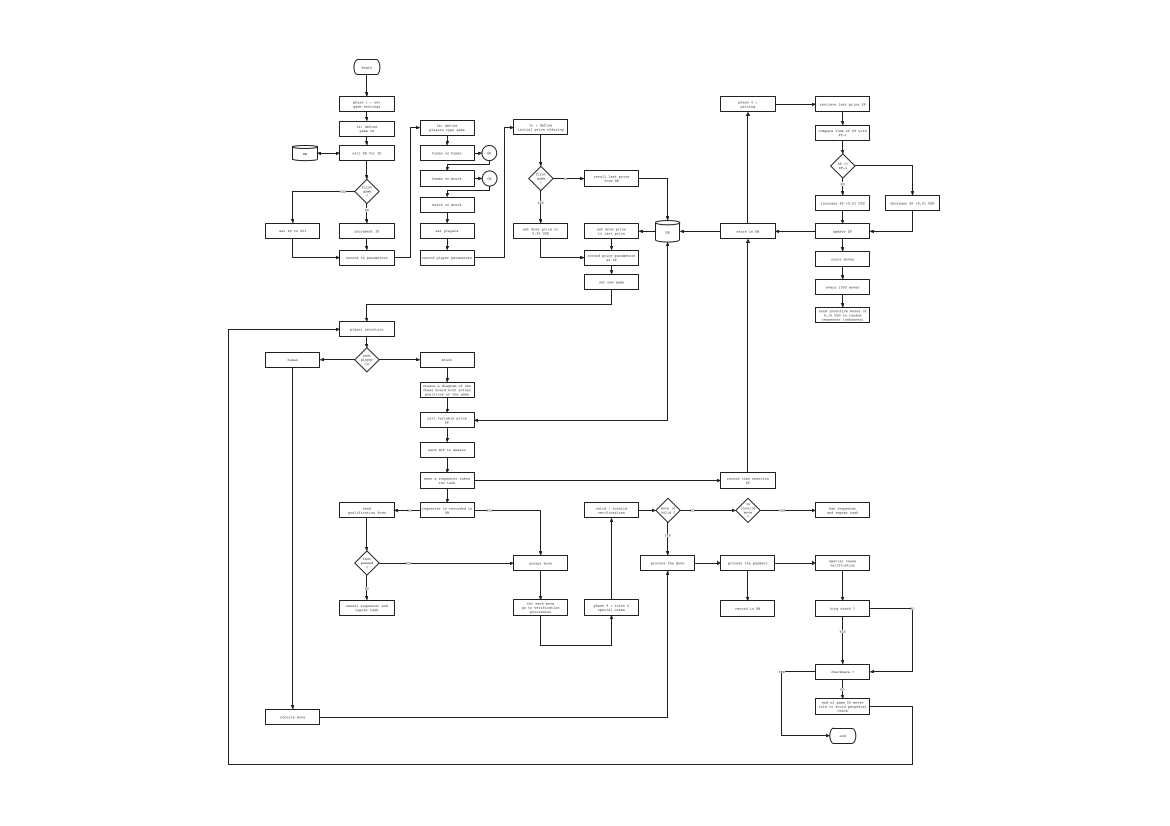

ADM 8 is a trading algorithm launched onto financial markets in September of 2011. Endowed with an initial 10,000 USD, it continuously buys and sells stock on the American, European, and Asian markets. Since its launch, and after 2,328 fully automated transactions, it has reached a +8.09% performance rate. The decision engine, based on a neural network and trained with historic stock prices, is intended to predict future stock price fluctuation.

The algorithmic structure of the programme, represented in this diagram, highlights the transient and highly speculative nature of algorithmic markets, where stock is sometimes only owned for a few microseconds, and underlines the obsessive futurologist behaviour of the algorithm, tirelessly repeating past tendencies in order to shape the future and thus create the possibility of black swans and flash crashes.7

1.2 – ADM X : The Algorithmic Trading Freakshow (2013)

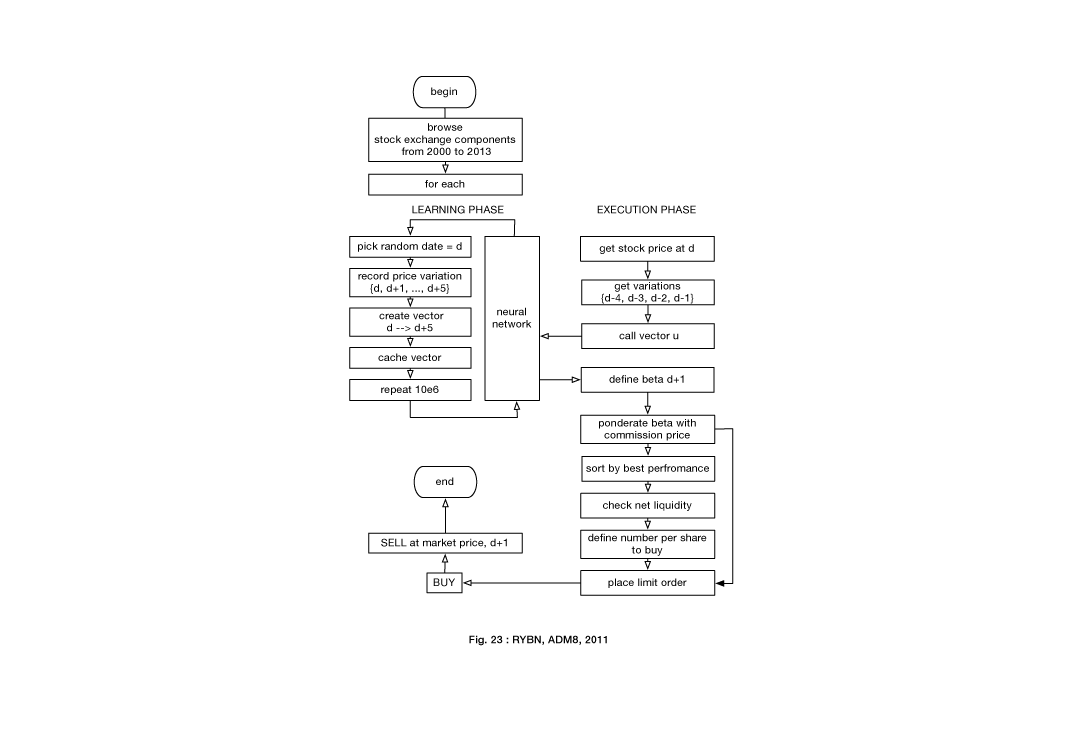

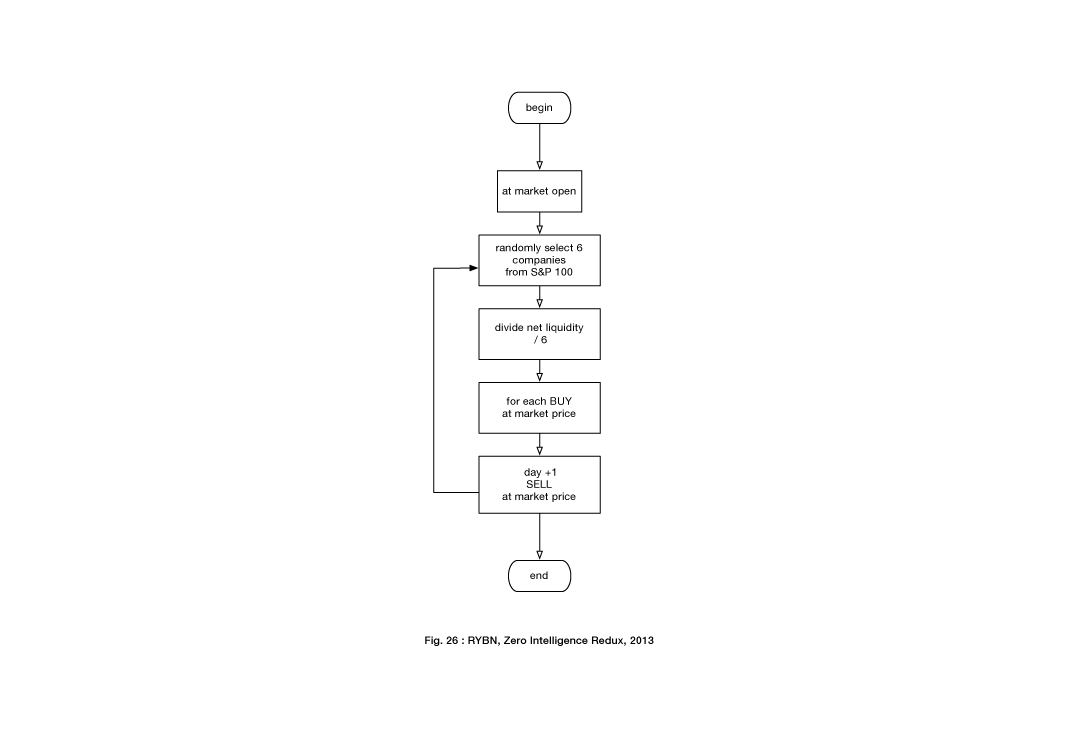

ADM X is a cabinet of curiosities of trading algorithms. The collection presents roughly forty different specimens which have all, either nearly or effectively, disrupted the stock market—flash crashes, collective behaviour freezes, targeted and coordinated attacks, etc. Each of these algorithms was recreated based on documentary research. The collection, presented in chronological order, offers a journey through the folklore of financial markets, and highlights the digital transformations of trading methods in the era of computer networking technologies. Some of the exhibited algorithms have been reprogrammed in order to be applied in a virtual market and observed in action.

1.3 – ADM XI (2015)

2 – Human Computers series (2015, ongoing)

2.1 – AAI Chess (2018)

AAI Chess is a piece that reenacts the 1770 Mechanic Turk hoax on Amazon’s micro-work platform MTurk. Workers, who are usually hired to train algorithms, are, in this case, paid to participate in a game of chess. The work is fragmented by task, and the AAI Chess algorithm determines the worker’s “salary” according to the data produced during the game.

Most often, the “salaries” follow a downward trend, which is the general tendency on micro-work platforms, where high pressure and heavy surveillance and evaluation systems preclude all possible organization or protest on behalf of workers who might try to outwit or exploit the system to their benefit. By accepting the tasks dictated by the algorithms, and with zero visibility either on the project to which they are contributing or on the context in which they are operating, the workers never cease to perfect a system designed entirely against them.

3 – The Great Offshore series (2017, ongoing)

Created as a part of the artistic research project entitled The Great Offshore, the Algoffshore series offers up speculative models of automated systems designed to optimize financial asset management. Each algorithmic model is a fiction and a story as much as it is a documentary piece, based upon the analysis of both complex tax-saving schemes and patents of automated systems. Each model is a potentially implementable system, having been verified by qualified professionals.

3.1 – Algoffshore 1 (2017)

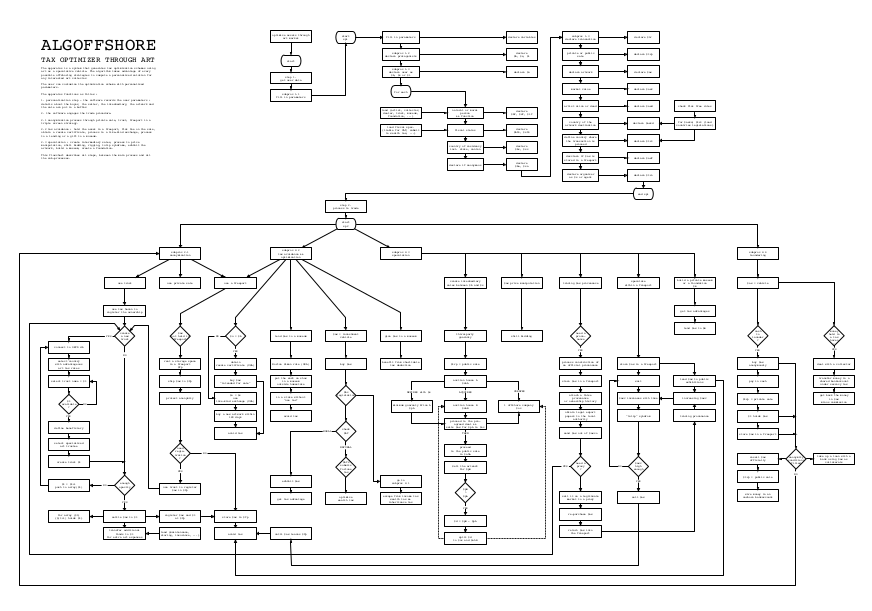

The Algoffshore 1: Tax Avoidance Scheme Generator, born from the careful analysis of Lux Leaks (8) tax scripts, describes an automatic process of offshore tax avoidance schemes which are based upon the malleability of legislation placed under pressure from private interests. In this case, The Algoffshore 1: Tax Avoidance Scheme Generator, born from the careful analysis of Lux Leaks8 tax scripts, describes an automatic process of offshore tax avoidance schemes which are based upon the malleability of legislation placed under pressure from private interests. In this case, algorithmic governance manifests in the power shift towards dehumanized and automated processes. These processes facilitate the rise of new forms of governance, which come to us from the private sector and spread even to the heart of public institutions. In turn, these new forms of governance bring about a global governmentality which we may define, in Benjamin Bratton’s words, as an accidental mega-structure9 or a cybernetic Leviathan.

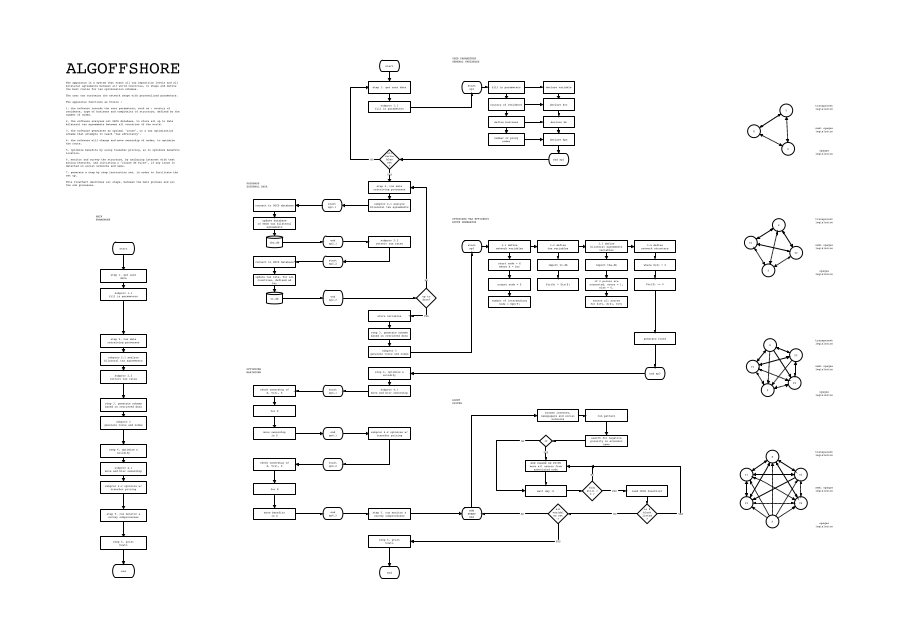

3.2 – Algoffshore 2 : Tax Optimizer Through Art (2018)

Algoffshore 2: Tax Optimizer Through Art addresses the use of artworks as mere financial assets, the mutations of the art market, and the tax optimization methods specific to that market, determined by the laws that (de)regulate them. The algorithm is equally based on a study of different artwork storage infrastructures, paired with that of title-deed transaction networks, such as free ports, which are the foundation of the contemporary art market. This model was verified by qualified professionals in 2018 during the Art Basel fair.

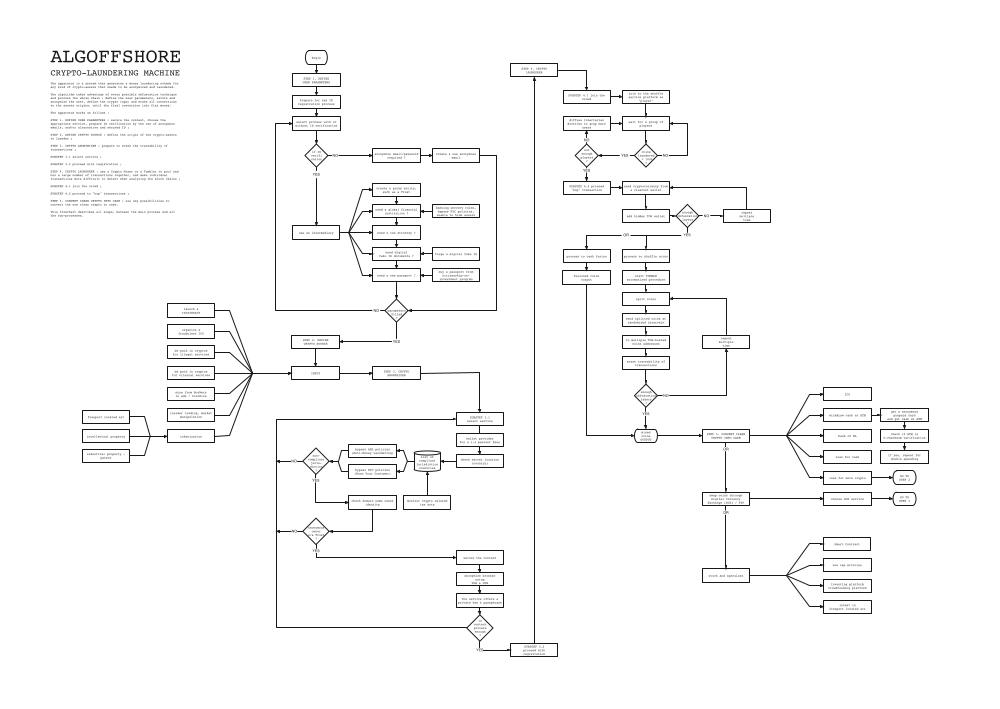

3.3 – Algoffshore 4 : Crypto Laundering Machine (2020)

Algoffshore 4: Crypto Laundering Machine examines the growing impact of crypto-currencies and blockchain technology in the international mechanisms of tax evasion, fraud, and money laundering. Created from various police, legal, and institutional sources, the algorithm aims to crystallize the institutionalization of these technologies as they gain ground in offshore banking practices and revamp an image of trust and transparence which, in fact, could not be further from the reality of how these technologies are applied in the covert world of tax fraud piloted by Luxembourg, Malta, and Switzerland’s marketplaces.

Recent academic and artistic research has proven the absolute non-neutrality of algorithms. Algorithms are filled with bias,10 introduced either at the stage of design—an algorithm can reproduce its creator’s bias—or in the phases of training and learning. However, not looking beyond that bias could lead us to conclude that simple adjustments and corrections would suffice in order for these algorithms to operate in a fairer, more ethical way.11 Instead, we must embrace a more critical approach, and consider the deeper nature of these technical systems, taking into account the whole of the circumstances in which they are created, distributed, and used. We must observe the algorithms’ very mode of existence12 that experts like so much to keep hidden away from the public, under the pretense of complexity and technicality. This deliberate distancing has created tension in the whole of the social body. Researcher Dan McQuillan has conceptualized this tension under the term state of algorithmic exception.13

RYBN.ORG’s projects invite us to experience this tension, whether it be through exploring environments and technical temporalities which are usually inaccessible and alien to us (financial markets evolving per microsecond in ADM 8); through the collective vertigo induced by crazed machines and governance methods derived from offshore finances (in the Algoffshores series); or through the bodily experience of human labour commanded by technical systems (Human Computers). These explorations of the laboratories in which algorithmic governance is bred give us the opportunity to experience the phenomena intimately. Only from then on can the collective elaboration of critical thought become possible.

Antoinette Rouvroy and Thomas Berns, “Gouvernementalité algorithmique

et perspectives d’émancipation. Le disparate comme condition d’individuation par la relation ?” 2013, Réseaux n°177.

Brian Holmes, “L’extra-disciplinaire, vers une nouvelle critique institutionnelle,” Multitudes, 2007.

Antonio Casilli, “En attendant les robots”, Ed. Seuil, 2019

- Along with the works of Friedrich Kittler, Grammophone, Film, Typewriter (1999); Jussi Parikka, What is Media Archaeology? (UGA, 2018); and Vilém Flusser, Towards a Philosophy of Photography (1984).

Alain Supiot, “La gouvernance par les nombres” Ed. Fayard, 2015; Cours au collège de France 2012/2013, “Du gouvernement par les lois à la gouvernance par les nombres,” 2012, and “Les figures de l’allégeance,” 2013.

- After Shintaro Miyasaki’s definition, introduced in the article,”‘Critical Re-Modelling of Artificial, Algorithm-Driven Intelligence as a Form of Commonist Media Practice”.

- See: Benoit Mandelbrot and Richard Hudson, Une approche fractale des marchés: risquer, perdre et gagner, Odile Jacob, 2009; Nassim Nicholas Taieb, Le cygne noir: La puissance de l’imprévisible, Les belles lettres, 2009; Eric Hunsader et al., “Financial Black Swans Driven by Ultrafast Machine Ecology,” SSRN Electronic Journal, February 2012.

Lux Leaks, ICIJ.

- Benjamin Bratton, The Stack. On Software and Sovereignty, MIT Press, 2015.

- See Kate Crawford, “The Hidden Biases of Big Data,” Harvard Business Review, 2013; Danna Boyd, “Undoing the Neutrality of Big Data,” Florida Law Review 67, 2016; and “Constant, cqrrelations,” 2015/2016.

- See, for example, the discussions on AI Fairness in the post “Fair AI: How to Detect and Remove Bias from Financial Services AI Models”; or the article “Design AI so that it’s fair,” which perfectly illustrates the solutionist tendency.

- Here, mode of existence refers as much to Gilbert Simondon’s On the Mode of Existence of Technical Objects (1958) as to Bruno Latour’s Enquête sur les modes d’existence. Une anthropologie des Modernes, Fayard/La découverte, (2012).

- Dan McQuillan, “Algorithmic states of exception,” 2015.

RYBN.ORG is a platform for artistic, experimental and independent research created in 1999 and based in Paris. The collective follows an “extra-disciplinary” research methodology, on the functioning of complex and esoteric phenomena and systems – high-frequency trading algorithms, architecture of the offshore economy, structure of financial markets, hermeneutics of Kabbalah, communication network management protocols, computer viruses, etc. – that are the subject of a number of research projects. On the basis of these investigations, RYBN.ORG produces devices, which evolve beyond the artistic field alone, based on processes of intrusion and contamination, in order to integrate environments and terrains where these objects are able to generate particular resonances: social networks, financial markets, patents, radio-electromagnetic spectrum.

RYBN.ORG is a platform for artistic, experimental and independent research created in 1999 and based in Paris. The collective follows an “extra-disciplinary” research methodology, on the functioning of complex and esoteric phenomena and systems – high-frequency trading algorithms, architecture of the offshore economy, structure of financial markets, hermeneutics of Kabbalah, communication network management protocols, computer viruses, etc. – that are the subject of a number of research projects. On the basis of these investigations, RYBN.ORG produces devices, which evolve beyond the artistic field alone, based on processes of intrusion and contamination, in order to integrate environments and terrains where these objects are able to generate particular resonances: social networks, financial markets, patents, radio-electromagnetic spectrum.